PERFORMACE

The rent remains at a steady level.

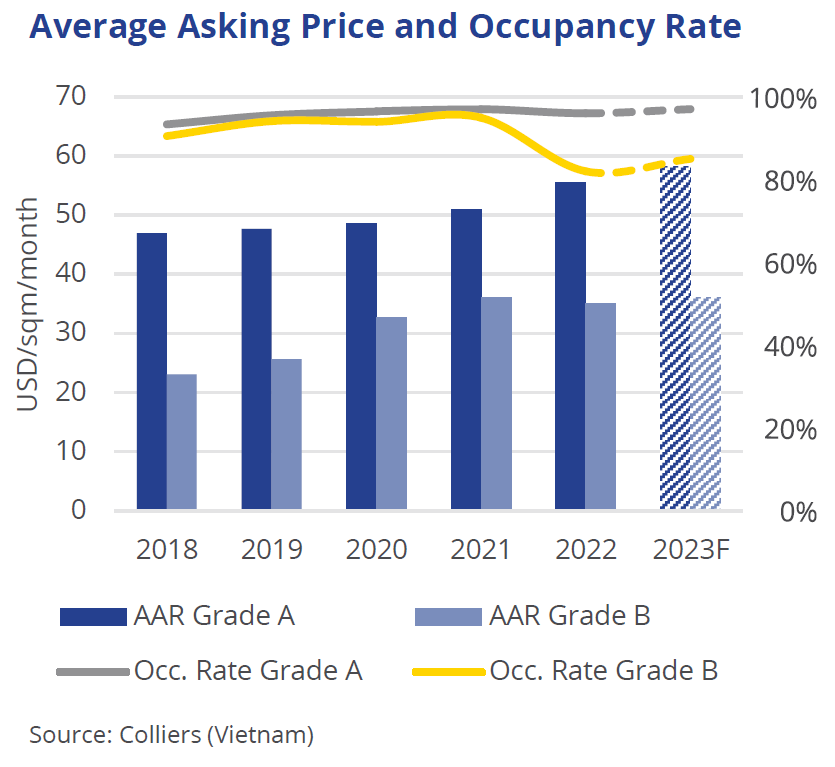

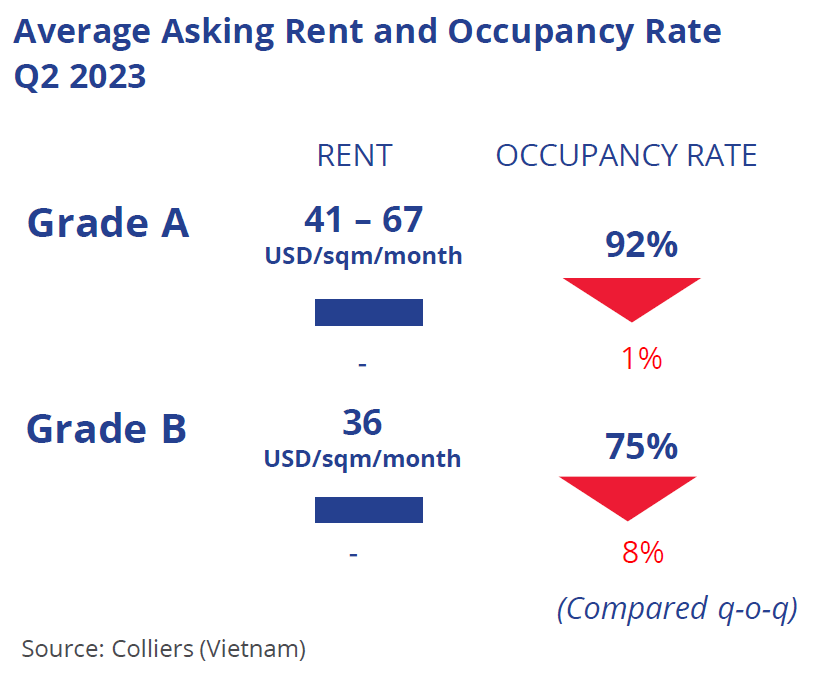

Stable rental prices were observed in the office market of Ho Chi Minh in Q2 2023.However, the occupancy rate slightly decreased compared to the previous quarter, with Grade A offices reaching 92% and Grade B offices achieving 75%. Additionally, the average rental prices remained relatively unchanged, with Grade A offices ranging from 41-67 USD/sqm/month and Grade B offices around 36 USD/sqm/month. New projects entering the market in outer CBD areas showed a promising occupancy rate of approximately 20-25%. Furthermore, investor are actively seeking tenants, and it is expected that the occupancy rate will increase in the near future.

Source: Colliers (Vietnam)

Source: Colliers (Vietnam)

Việt Nam's economic growth forecast at 7.5 per cent in 2022

Việt Nam's economic growth forecast at 7.5 per cent in 2022  “Shopping” for a virtual office during the Covid-19 pandemic is surprisingly beneficial.

“Shopping” for a virtual office during the Covid-19 pandemic is surprisingly beneficial.  Napping at Workplace and its Benefits

Napping at Workplace and its Benefits  VIETNAM NEWS HIGHLIGHTS - MAY 2021.

VIETNAM NEWS HIGHLIGHTS - MAY 2021.  VIETNAM REAL ESTATE INVESTMENT MARKET OVERVIEW AND OUTLOOK 2022

VIETNAM REAL ESTATE INVESTMENT MARKET OVERVIEW AND OUTLOOK 2022 2 Bis - 4 - 6, CJ BUILDING

No. 6 Le Thanh Ton street, Sai Gon Ward, HCMC

Tel: +84 28 6255 6800 | Fax: +84 28 6255 6801

Email: leasing@cjbuilding.com.vn